Kids and Money - 3 Pathways to Financial Literacy

You can teach children to be financially literate. With your guidance, the children in your life can develop intuition around the concepts of cash flow, debt and passive income that will continue to serve them in their lives as adults. Begin your child's understanding today by using these 3 pathways.Pathway 1: Action Over Words

In other words, do not lecture children on concepts like compound interest. Let them experience it. Financial systems are fascinating, but complicated. Studying the parts such as banks, markets, or derivatives will do little to illuminate the behavior of all those parts working together. There is a place for academic study of the topic, but intuition won through experience needs to come first. Fortunately, people can gain that experience by participating in a financial system through earning, spending, borrowing and investing. Unfortunately, those can be some tough lessons to learn as an adult when the stakes and potential damage are high. This brings us to Pathway 2.Pathway 2: You are the Bank

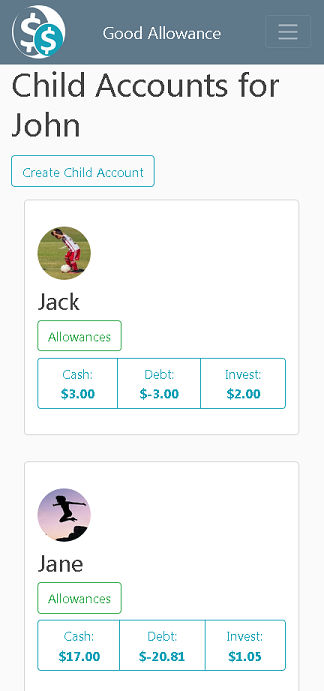

Make yourself the bank, the credit card company, and the investment broker. Why? Love. You, not the bank, love the child. You, not the credit card company, are deeply interested in the child’s development and wellbeing. You, not the broker, will be there to pick the kids up and dust them off when their financial lives spiral out-of-control. With you standing in for the financial institutions, the hard lessons can be taught without the long-term damage.Here’s how to do it:

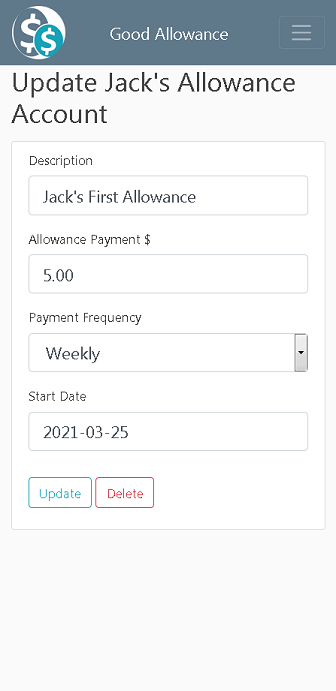

- Provide an allowance. An allowance will provide an income to play with and begin your child's financial journey. Structure the allowance however you like. The goal here is for kids to see and anticipate money flowing to their account.

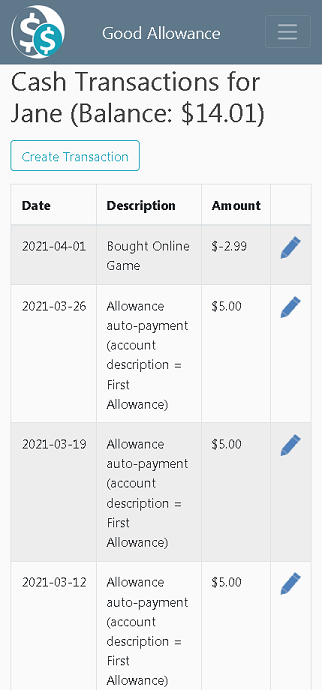

- Keep a record of their spending and review it together. I recently sat down with my 13 year-old son to review his spending over the last five years. It was very rewarding for me to watch him shake his head in disappointment at all the money he had “wasted” over the years on things he no longer values (in-app purchases for Clash of Clans were his weakness).

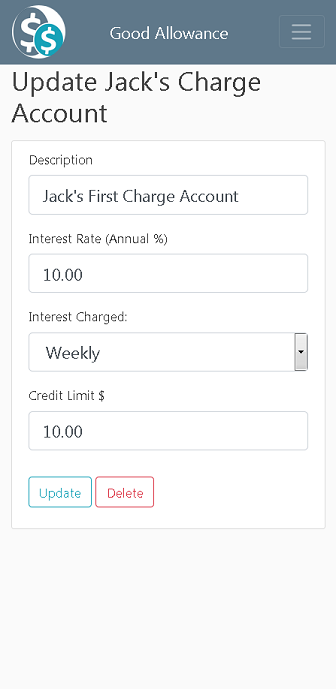

- Offer debt. Is borrowing good or bad? Borrowing with a poor understanding of borrowing is decidedly bad. Giving kids a loan (especially with high interest) allows them to experience its compounding nature. Let them know the pain of using all of their income just to pay off a loan, or the brutality of using all of that income just to pay the interest charges.

- Create unanticipated costs. Like flat tires and root canals, real life is filled with unanticipated events and their associated costs. Let kids learn to think ahead and prepare for such events in their financial future by showing them now how to handle rainy days. When Junior leaves the milk out and it sours or they get a flat tire on their bike, charge them. Let them learn early that surprises and consequences are a part of financial life.

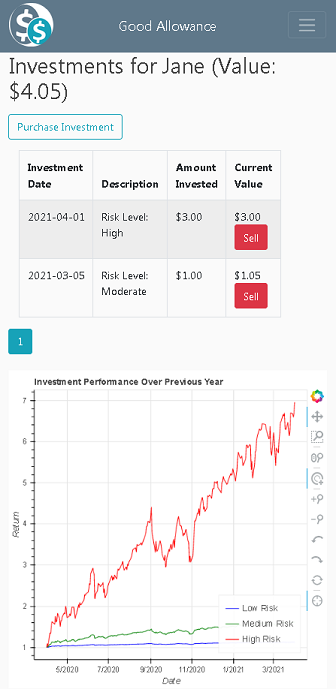

- Provide investment opportunities so they can experience the risks and rewards of a passive income. Through paper trading, one can pretend to buy shares or even fractions of a share of company XYZ and follow its investment performance. If they exit the investment in the black, reach into your pocket and pay up. If they lose, pat them on the back and say “those are the breaks, kid.” [Interestingly, play investments combined with debt can lead the child towards the highly risky world of leveraged investing or investing with borrowed money.]

Pathway 3: Survival Comes First

You may have noticed that throughout this thread I slant towards the negative, eagerly identifying ways for the kids to get into trouble. This is intentional as I am convinced that healthy money management habits are first and foremost about survival. In his book Skin in the Game, Nassim Taleb states “Survival comes first, truth, understanding, and science later.” He then quotes Warren Buffet as similarly saying “to make money you must first survive.” Not bad advice from a few individuals known for creating wealth. The lesson is that a financial education is not about winning riches, but avoiding ruin. Easily recognizing the path to ruin is the skill that they require when children grow up and are out on their own in the big bad world. Within the safe environment you establish in Pathway 2, give children experiences that lead to those negative outcomes. Let them build their intuition about financially harmful decisions. Armed with that intuition, they can spend their adult lives side-stepping the money management pitfalls that have ensnared so many who have come before.Conclusion

Let's raise a generation of financially literate children! Build up their financial intuition through experience. Make those experiences safe by playing the role of the financial institutions. Finally, keep the focus on financial survival.Good luck!